- Details

- Written by Roldan M. De Villa

- Category: 2011 Annual Budget

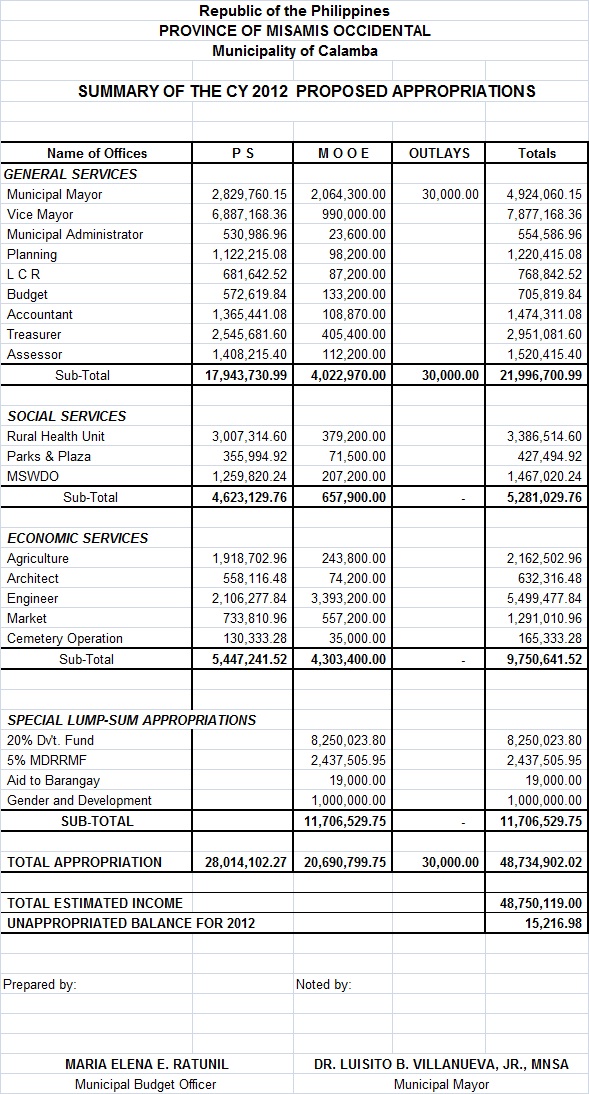

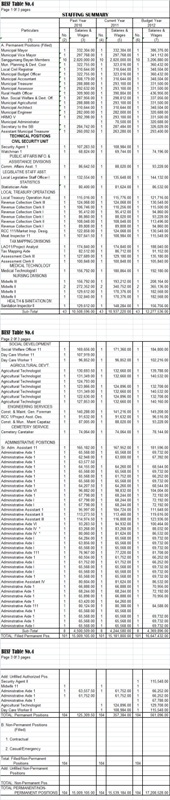

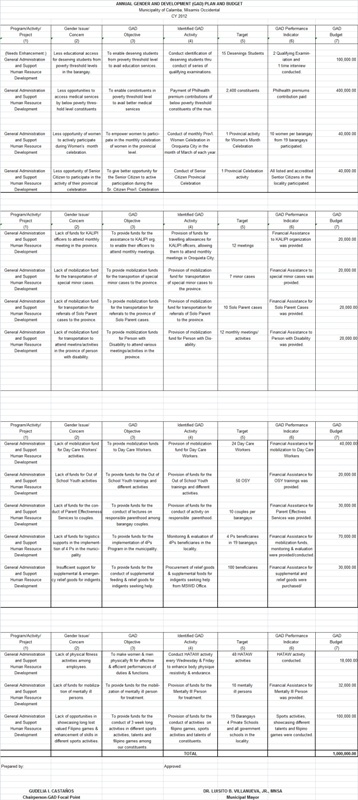

| 2012 Budget |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

Note: Download JPEG file to Zoom the Document.

- Hits: 7073

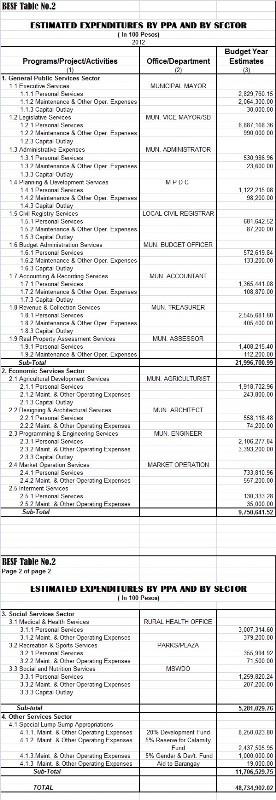

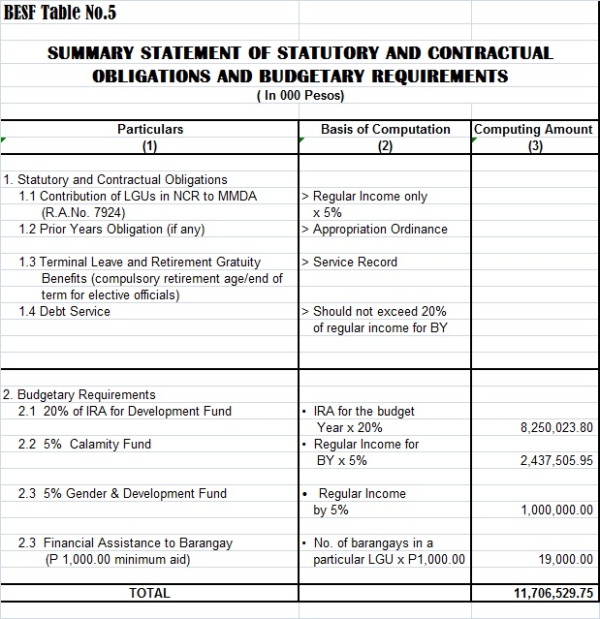

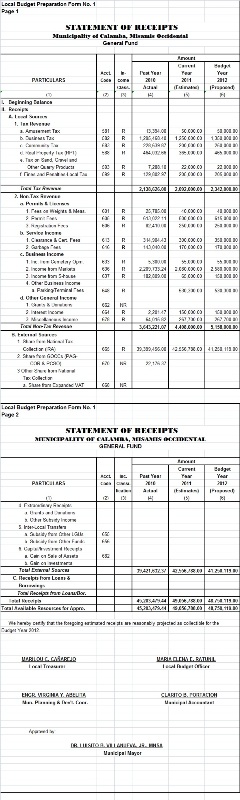

| 2012 Budget |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

Note: Download JPEG file to Zoom the Document.

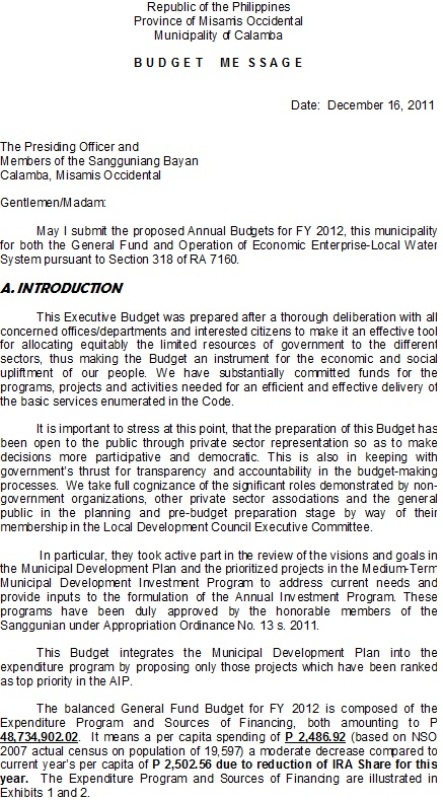

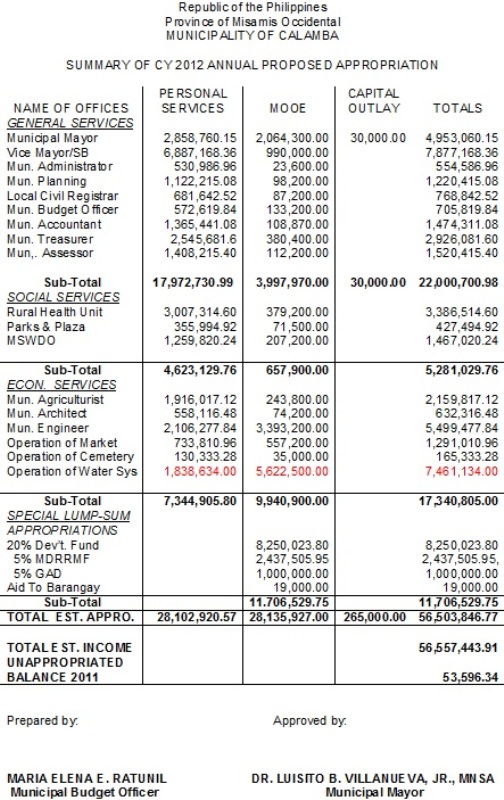

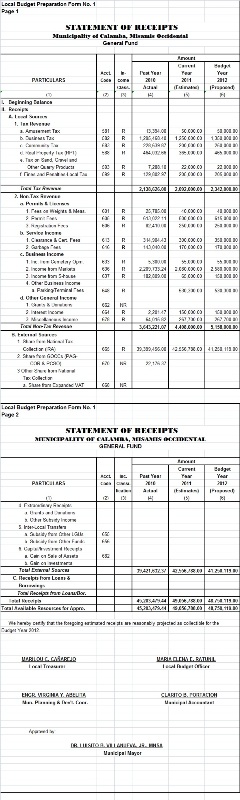

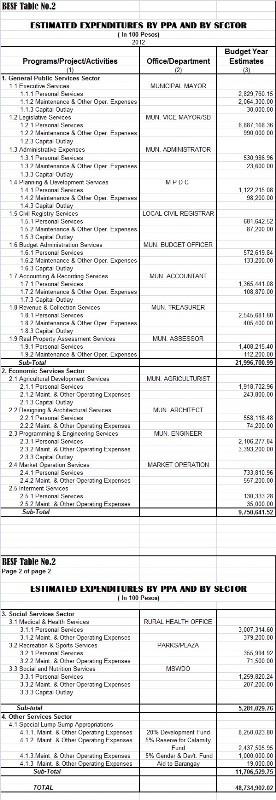

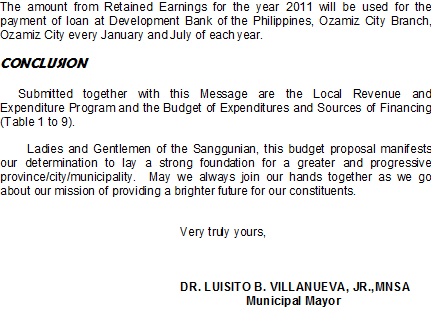

Republic of the Philippines Province of Misamis Occidental MUNICIPALITY OF CALAMBA

STATEMENT OF RECEIPTS Calendar Year 2011

Prepared by: Approved by:

(SGD).MARIA ELENA E. RATUNIL (SGD.) DR. LUISITO B. VILLANUEVA, JR., MNSA Municipal Budget Officer Municipal Mayor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

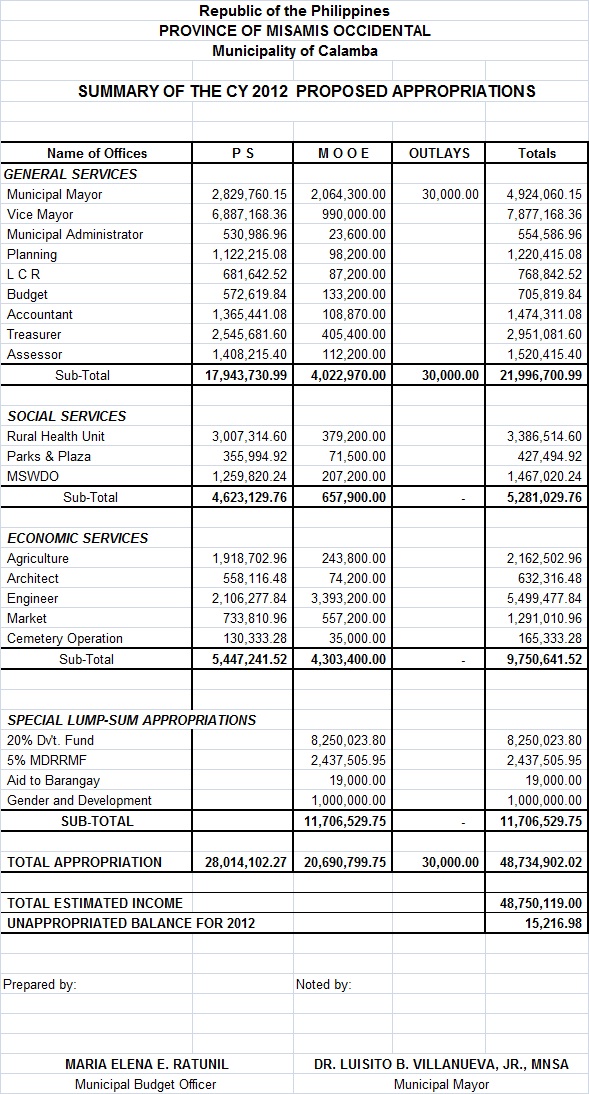

Republic of the Philippines Province of Misamis Occidental Municipality of Calamba

B U D G E T M E S S A G E

Date: December 15, 2010

The Presiding Officer and Members of the Sangguniang Bayan Calamba, Misamis Occidental

Gentlemen/Madam:

May I submit the proposed Annual Budgets for FY 2011, this municipality for both the General Fund and Operation of Economic Enterprise-Local Water System pursuant to Section 318 of RA 7160.

A. INTRODUCTION

This Executive Budget was prepared after a thorough deliberation with all concerned offices/departments and interested citizens to make it an effective tool for allocating equitably the limited resources of government to the different sectors, thus making the Budget an instrument for the economic and social upliftment of our people. We have substantially committed funds for the programs, projects and activities needed for an efficient and effective delivery of the basic services enumerated in the Code.

It is important to stress at this point, that the preparation of this Budget has been open to the public through private sector representation so as to make decisions more participative and democratic. This is also in keeping with government’s thrust for transparency and accountability in the budget-making processes. We take full cognizance of the significant roles demonstrated by non-government organizations, other private sector associations and the general public in the planning and pre-budget preparation stage by way of their membership in the Local Development Council Executive Committee.

In particular, they took active part in the review of the visions and goals in the Municipal Development Plan and the prioritized projects in the Medium-Term Municipal Development Investment Program to address current needs and provide inputs to the formulation of the Annual Investment Program. These programs have been duly approved by the honorable members of the Sanggunian under Appropriation Ordinance No. 01 s. 2011.

This Budget integrates the Municipal Development Plan into the expenditure program by proposing only those projects which have been ranked as top priority in the AIP.

The balanced General Fund Budget for FY 2011 is composed of the Expenditure Program and Sources of Financing, both amounting to P 49,042,713.57. It means a per capita spending of P 2,502.56, (based on NSO 2007 actual census on population of 19,597) a moderate increase compared to current year’s per capita of P 2,210.17. The Expenditure Program and Sources of Financing are illustrated in Exhibits 1 and 2.

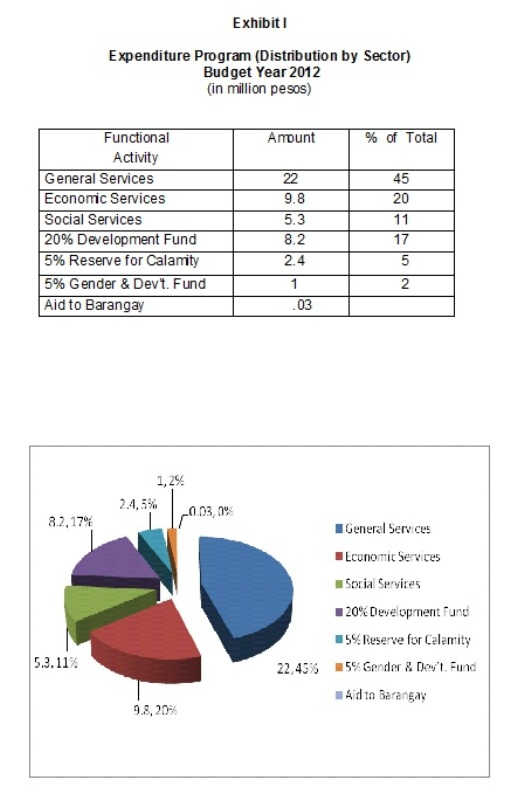

Exhibit I

Expenditure Program (Distribution by Sector) Budget Year 2011 (in million pesos)

|

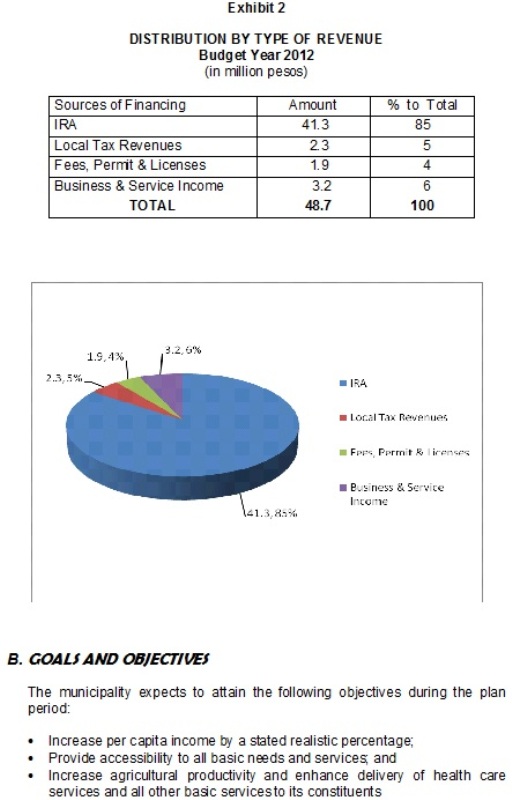

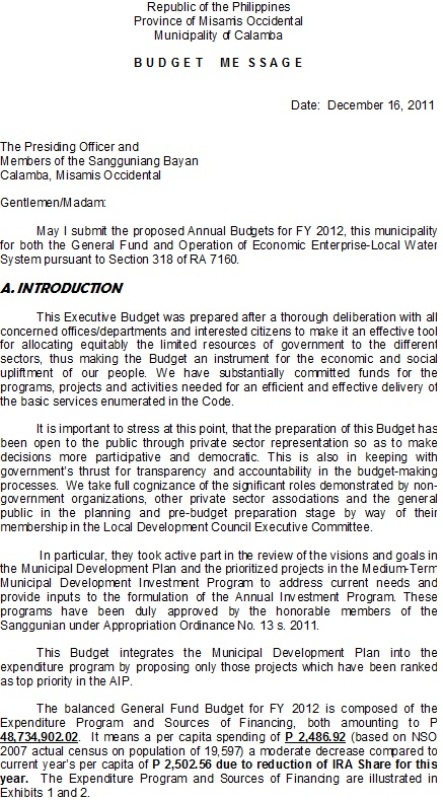

Exhibit 2

DISTRIBUTION BY TYPE OF REVENUE Budget Year 2011 (in million pesos)

B. GOALS AND OBJECTIVES

The municipality expects to attain the following objectives during the plan period:

C. FISCAL POLICIES

Revenue – generating measures include enhanced tax collection via a vigorous tax information campaign and intensified tax collection effort by the revenue collection personnel. Likewise, also to be looked into by the administration is the implementation of the newly revised Local Revenue Code that will eventually raise the taxing power of the LGU and at the same time increase in its local revenues. Also the local government unit’s revenue taxes and fees will be comparable with other LGUs

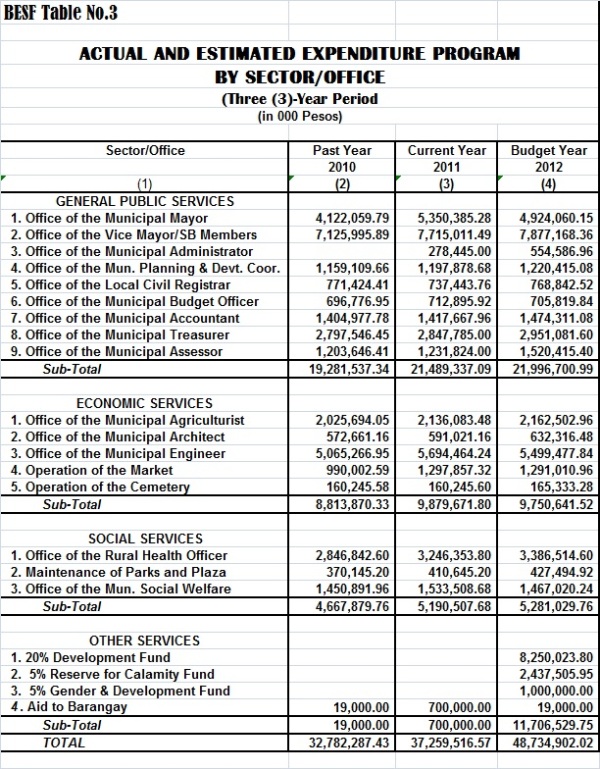

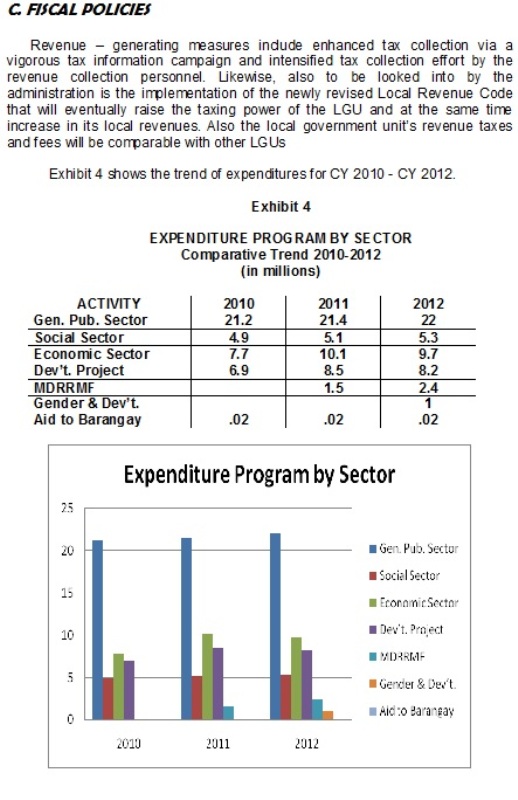

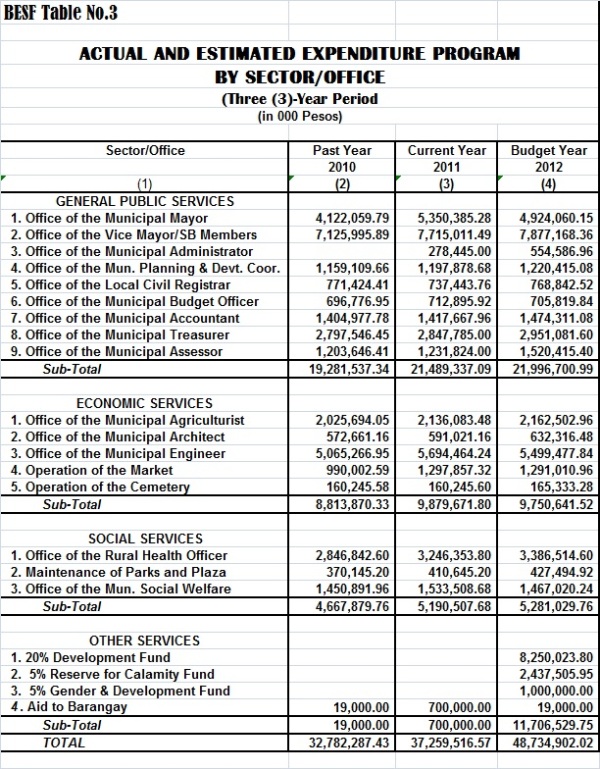

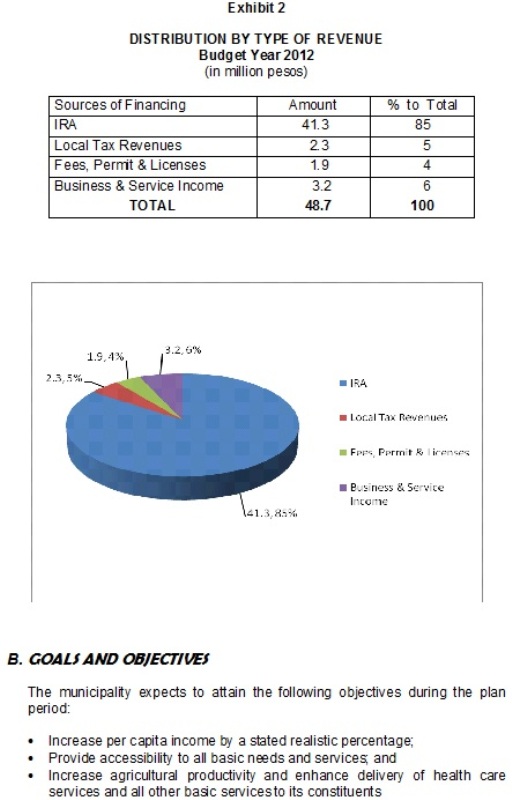

Exhibit 4 shows the trend of expenditures for CY 2009 - CY 2011.

Exhibit 4

EXPENDITURE PROGRAM BY SECTOR Comparative Trend 2009-2011 (in millions)

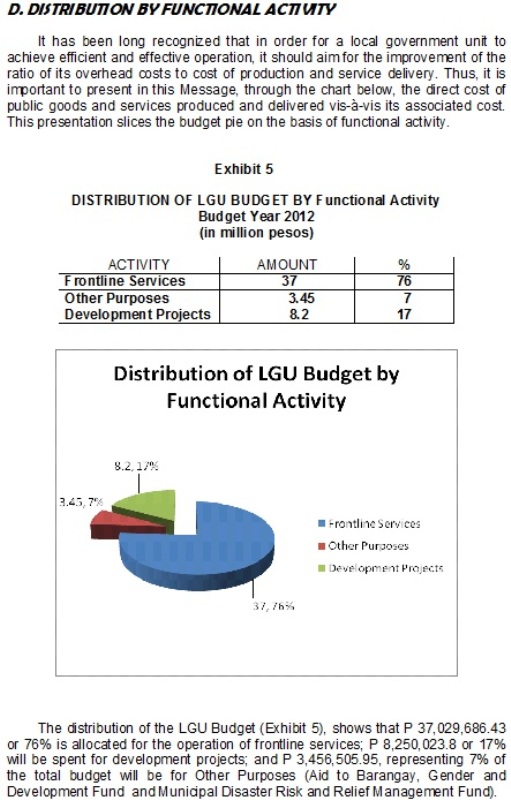

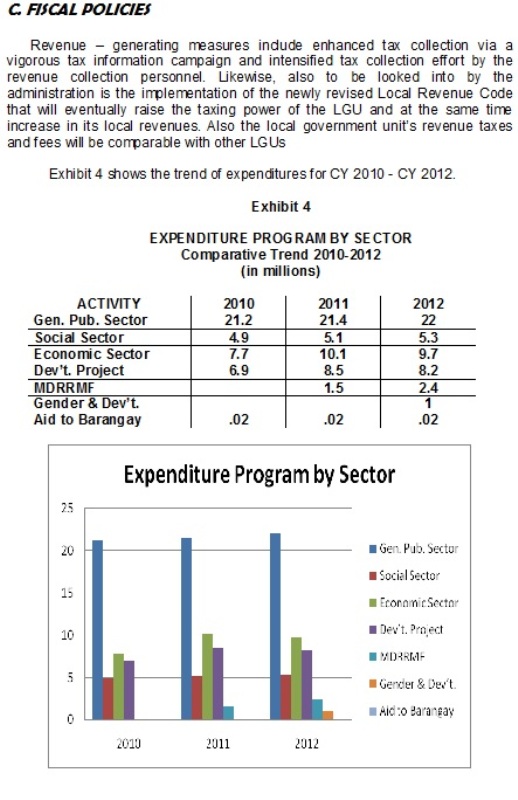

D. DISTRIBUTION BY FUNCTIONAL ACTIVITY

It has been long recognized that in order for a local government unit to achieve efficient and effective operation, it should aim for the improvement of the ratio of its overhead costs to cost of production and service delivery. Thus, it is important to present in this Message, through the chart below, the direct cost of public goods and services produced and delivered vis-à-vis its associated cost. This presentation slices the budget pie on the basis of functional activity.

Exhibit 5

DISTRIBUTION OF LGU BUDGET BY Functional Activity Budget Year 2011 (in million pesos)

The distribution of the LGU Budget (Exhibit 5), shows that P 36,824,515.77 or 75% is allocated for the operation of frontline services; P 8,511,357.60 or 17% will be spent for development projects; and P 3,971,839.50, representing 8% of the total budget will be for Other Purposes (Aid to Barangay, Gender and Development Fund and Municipal Disaster Risk and Relief Management Fund).

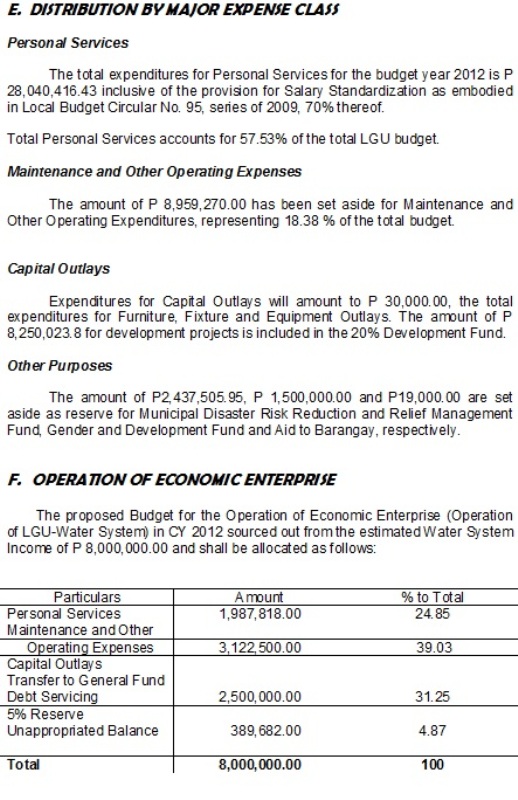

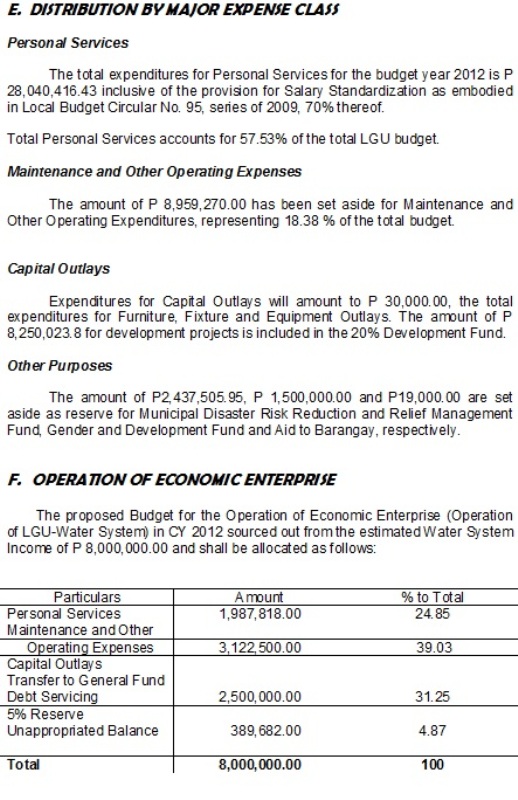

E. DISTRIBUTION BY MAJOR EXPENSE CLASS

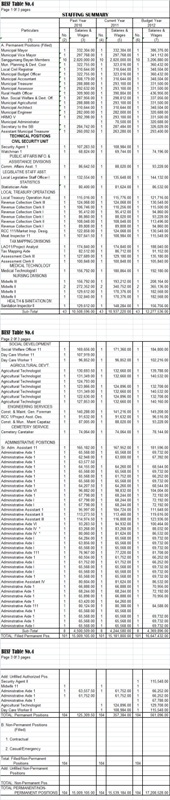

Personal Services

The total expenditures for Personal Services for the budget year 2011 is P 26,264,057.00 inclusive of the provision for Salary Standardization as embodied in Local Budget Circular No. 92, series of 2009.

Total Personal Services accounts for 53.55% of the total LGU budget.

Maintenance and Other Operating Expenses

The amount of P 10,030,230.00 has been set aside for Maintenance and Other Operating Expenditures, representing 20.45 % of the total budget.

Capital Outlays

Expenditures for Capital Outlays will amount to P 265,000.00 or .51% of the total expenditures for Furniture, Fixture and Equipment Outlays. The amount of P 8,511,357.60 for development projects is included in the 20% Development Fund.

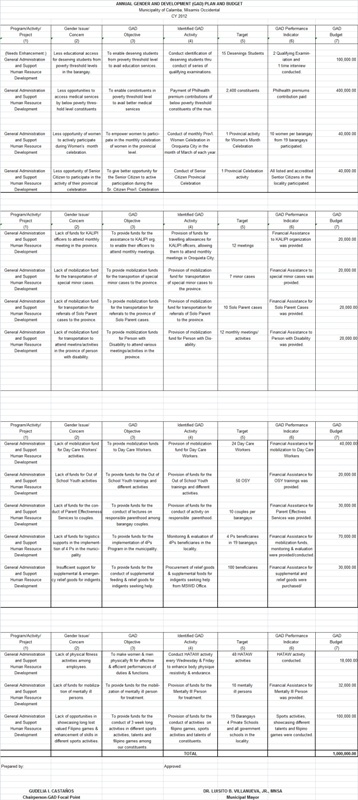

Other Purposes

The amount of P2,294,974.20, P 1,500,000.00 and P19,000.00 are set aside as reserve for Municipal Disaster Risk Reduction and Relief Management Fund, Gender and Development Fund and Aid to Barangay, respectively.

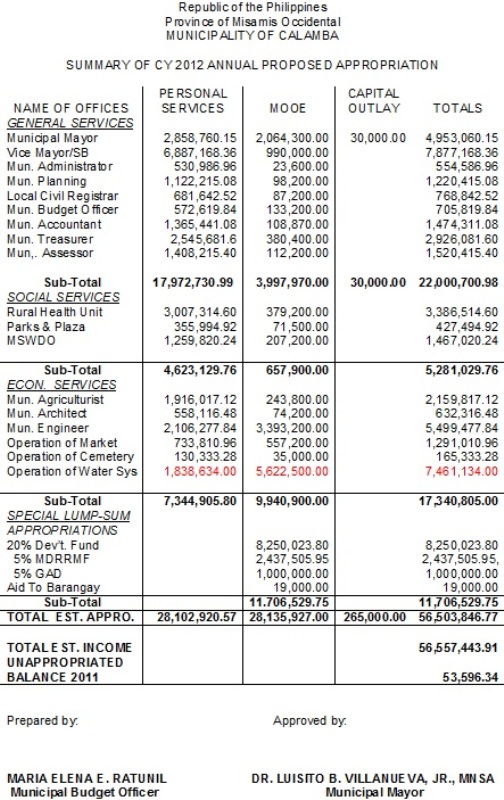

F. OPERATION OF ECONOMIC ENTERPRISE

The proposed Budget for the Operation of Economic Enterprise (Operation of LGU-Water System) in CY 2011 shall be sourced from the estimated Water System Income of P7,500,655.91 allocated as follows:

The amount of P 2,500,000.00 plus an additional amount from Retained Earnings for the year 2010 will be used for the payment of loan at Development Bank of the Philippines, Ozamiz City Branch, Ozamiz City every January and July of each year.

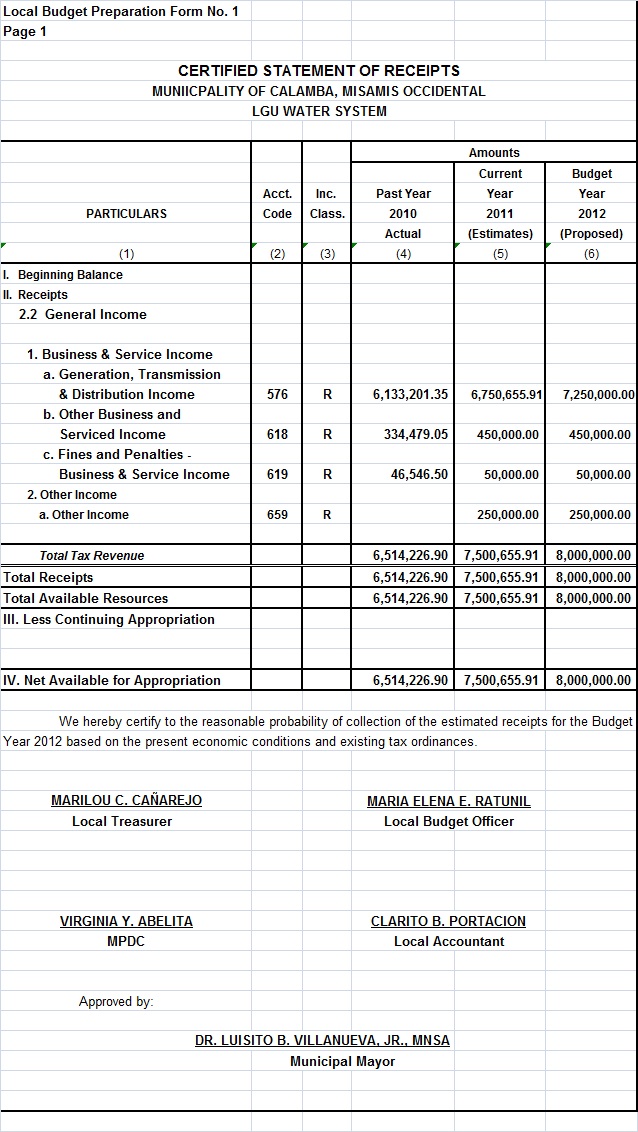

CONCLUSION

Submitted together with this Message are the Local Revenue and Expenditure Program and the Budget of Expenditures and Sources of Financing (Table 1 to 9).

Ladies and Gentlemen of the Sanggunian, this budget proposal manifests our determination to lay a strong foundation for a greater and progressive province/city/municipality. May we always join our hands together as we go about our mission of providing a brighter future for our constituents.

Very truly yours,

DR. LUISITO B. VILLANUEVA, JR.,MNSA Municipal Mayor

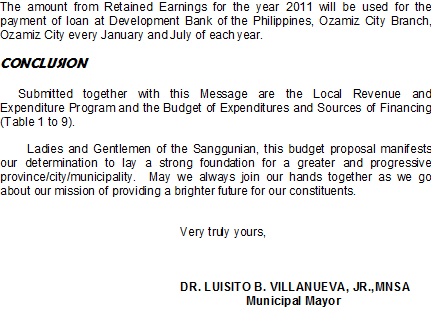

Republic of the Philippines Province of Misamis Occidental MUNICIPALITY OF CALAMBA

SUMMARY OF CY 2011 ANNUAL PROPOSED APPROPRIATION

Prepared by: Approved by:

MARIA ELENA E. RATUNIL DR. LUISITO B. VILLANUEVA, JR., MNSA Municipal Budget Officer Municipal Mayor |